ECONOMIC CRIME

We are cracking down on those supporting Putin’s campaign of destruction:

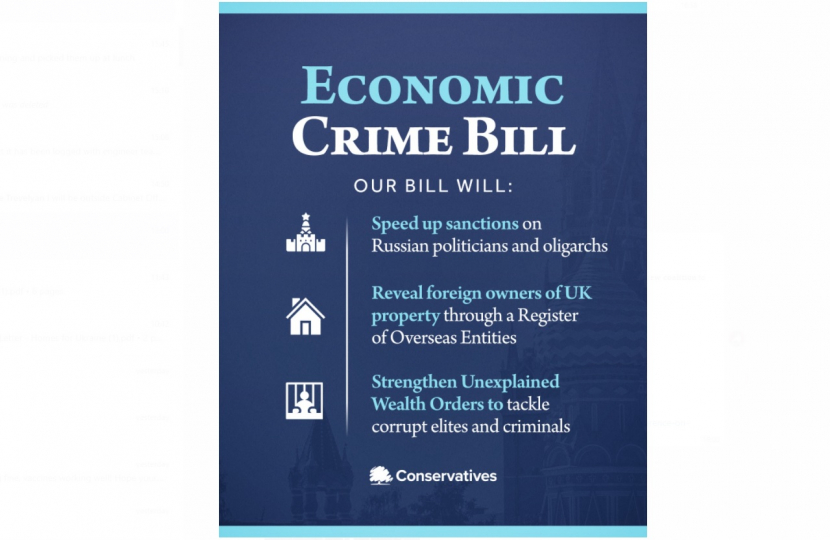

- We are expediting the Economic Crime (Transparency and Enforcement) Bill through Parliament, cracking down on corrupt elites and ramping up pressure on Putin’s regime. The Economic Crime (Transparency and Enforcement) Bill has passed in the House of Commons, and we are looking for swift passage in the Lords in order to get Royal Assent as soon as possible.

- We amended the Economic Crime (Transparency and Enforcement) Bill to allow us to crack down faster on those supporting Putin. Our amendments will allow the UK to align more rapidly with the individual sanction designations imposed by our allies such as the US, Canada and the EU via an urgent designation procedure and will remove the test of ‘appropriateness’ for sanction designations so we can move faster.

- We will shorten the deadline for overseas companies to register their beneficial owners, cracking down on money laundering through UK property. We will shorten the deadline from 18 months to six months – cracking down on money laundering whilst also giving people who hold their property in overseas entities for legitimate reasons appropriate time to comply with the new requirements.

- We are creating a register of overseas entities, exposing foreign property owners who try to hide behind secretive shell companies. The new register will require anonymous foreign owners of UK property to reveal their real identities to ensure criminals cannot hide behind secretive shell companies, with those who break the rules facing up to 5 years in prison and restrictions on selling their property.

- We announced plans to reform Companies House, cracking down on those who abuse our framework and improving corporate transparency. The plans announced in our white paper will empower the Registrar of Companies to challenge dubious companies registered in the UK; removes the risk of overseas company registration agents from abusing our framework; introduces measures to stop certain individuals from being appointed as company directors; and tackles opaque ownership structures to only allow the appointment of UK-based corporate directors.