PLAN FOR A STRONGER ECONOMY

The last few years have been unprecedented – from a pandemic that has severely damaged the global economy to a cost of living challenge now being felt across the world.

Due to a series of global forces – economies reopening following the pandemic, Russia’s invasion of Ukraine, and a fresh wave of lockdowns in China – families and businesses are being hit here at home through a significant rise in inflation and therefore everyday prices.

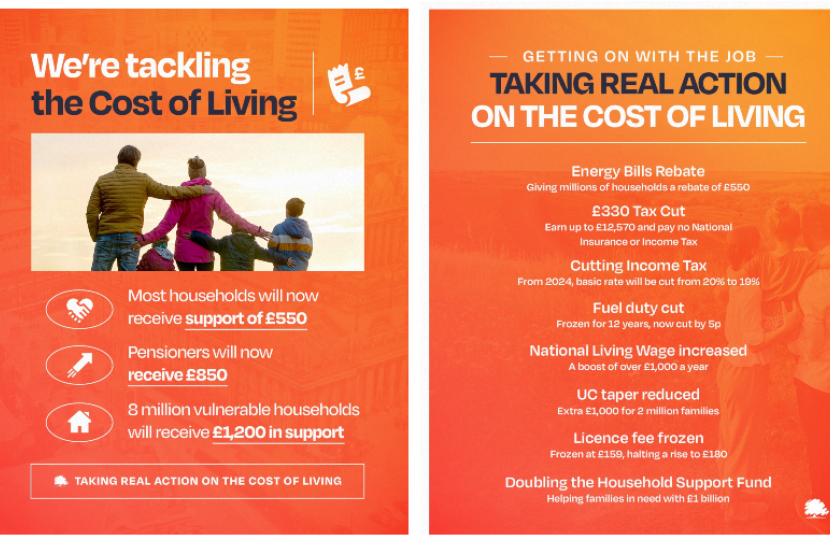

While it is impossible for any government to solve every problem, the priority today is to help the millions of families struggling with the cost of living. We are doing this today through a £15 BILLION package which will support the most vulnerable one-third of households with £1,200 each:

- Raising extra revenues through a new Energy Profits Levy, but without deterring investment

- Providing £9 BILLION targeted support to the most vulnerable households, including pensioners

- Supporting hard-working families with £6 BILLION to help with energy bills

- We are now providing a total of over £37 BILLION of support to help families with the cost of living. This forms part of our PLAN FOR A STRONGER ECONOMY – creating jobs, cutting taxes on working people, reducing borrowing and debt, driving businesses to invest and innovate, unleashing a skills revolution, seizing the benefits of Brexit, and levelling up growth throughout the UK.

Raising extra revenues through a new Energy Profits Levy, but without deterring investment

- A targeted and temporary Energy Profits Levy on profits of oil and gas companies. The new Levy will be charged on profits of oil and gas companies at a rate of 25 per cent, on top of the existing 40 per cent headline rate of corporation tax. It will be temporary, and as the oil and gas price returns to more historically normal levels, the Levy will be automatically phased out. The Levy will be in place from today, and will raise around £5 billion over the next twelve months. We are also evaluating the scale of the extraordinary profits made by the electricity generation sector, and considering the appropriate steps to take.

- Significant investment incentives will be built into the new Levy. A new Investment Allowance will double the overall investment relief for oil and gas companies, so companies will have a significant incentive to reinvest their profits. Modelled on the ‘super-deduction’, for every £1 an oil or gas company invests, they will pay 91 per cent less tax – so the more a company invests, the less tax they will pay. And this relief will be available straight away, rather than waiting for profits which is normal for existing investment reliefs.

- Oil and gas companies are currently seeing extraordinary windfall profits due to global spikes in commodity prices, driven in part by Russia’s war. That is why we are sympathetic to the argument to tax those profits fairly, as well as incentivising investment. Previous windfall taxes were introduced in 2011 by the Conservative-led government, by Labour in 1997, and by the Conservatives in 1981.

- Unlike Labour’s windfall tax, this Levy incentivises investment and raises more revenue. The Energy Profits Levy contains an Investment Allowance which doubles the overall investment relief for oil and gas companies – unlike Labour’s proposal. And our Levy raises around £5 billion over the next twelve months, whereas Labour estimates that their windfall tax only raises £2 billion.

Providing £9 BILLION targeted support to the most vulnerable households, including pensioners

- £650 cost of living payment for every household on means-tested benefits. This means over 8 million of the most vulnerable households (around one-third of all in the UK) will be directly sent a one-off cash payment of £650, paid out from DWP in two separate instalments, with the first due from July and the second in the Autumn. Payments from HMRC for those on Tax Credits will follow one month later. All those who live in the UK and are in receipt of Universal Credit, Jobseekers Allowance, Employment and Support Allowance, Income Support, Working Tax Credit, Child Tax Credit and Pension Credit are eligible.

- £300 pensioner cost of living payment for every pensioner household in receipt of Winter Fuel Payment. Around 8 million pensioner households already receive Winter Fuel Payments, which we have increased to £300. We will send all existing recipients an additional one-off £300 cash payment, due to be paid out automatically in November/December.

- £150 disability cost of living payment for those in receipt of disability benefits. For the nearly 6 million people who receive disability benefits – including Personal Independence Payments, Disability Living Allowance, and Attendance Allowance – there will be an additional one-off cash payment worth £150, paid out from DWP in September. This will help to pay for the higher costs often faced by those who require special equipment in their households.

- £500 million to help hard cases. We are providing an additional £500 million for the existing Household Fund from October, to ensure local councils can support those not covered by the above set of payments. Local councils will continue to have discretion over exactly how the funding is used.

Supporting hard-working families with £6 BILLION to help with energy bills

- Doubling the October £200 rebate to £400 – and turning it into a cash grant. As well as supporting those on the lowest incomes, it is also fair that we help ordinary working families. That is why the initial £200 rebate for every household we announced in February will be doubled to £400 – and we will cancel the existing clawback mechanism, thereby turning it into a £400 cash grant for every household. This will continue to be delivered by energy suppliers from October, with payments spread over six months.

- This package will benefit the lowest-income households by £1,200 – with some households receiving £1,650

- This package equates to £1,200 for those on the lowest incomes – around one-third of all households.

The lowest-income households on means-tested benefits will receive £650 from today’s one-off payment,

£400 from the energy bills cash grant, and £150 from the council tax rebate – totalling £1,200. For the 8 million most vulnerable households in the country, this £1,200 is comparable to the average energy bill increase over the course of this year.

- Pensioners will receive £850. A pensioner household will receive £300 through the additional Winter Fuel Payment, £400 from the energy bills cash grant and £150 from the council tax rebate – totalling £850.

- Hard-working families will receive £550. Most households will receive £150 from the council tax rebate, along with £400 from the energy bills cash grant – totalling £550.

- Some individuals could receive up to £1,650. A low-income household on pension credit with a disability would receive the £650 one-off payment, £300 through the Winter Fuel Payment, £150 for disability benefit recipients, £400 from the energy bills cash grant, and £150 from the council tax rebate – totalling £1,650.

- Our support to help families with the cost of living now totals over £37 billion. Today’s package of measures provides support worth over £15 billion. Combined with the over £22 billion of support we have already announced, we are supporting families with over £37 billion – or 1.6 per cent of GDP, similar/higher than France, Germany, Italy and Japan. Over three-quarters of our support will go to the most vulnerable households – including pensioners.

- Next year, we anticipate benefits will be uprated by this September’s CPI, which is likely to be significantly higher than the forecast inflation rate for next year.

Thanks to increasing the NLW, UC taper cut, personal threshold increase and our cost of living packages:

- A single mother of two children who works full-time on the National Living Wage will receive £2,500 this year in additional support (£850 from today’s package, £350 from the February package, £1,500 from the UC taper reduction).

- A low-income household (combined annual earnings of £26,000, including a full-time earner on £10 per hour and a part-time earner on the National Living Wage) with two children who are in receipt of means- tested benefits will receive £3,200 this year (£850 from today’s package, £350 from the February package, £2,000 from the UC taper reduction).

- A low-to-middle income working family with two children on Universal Credit (combined annual earnings of £43,000, including a full-time earner on an hourly wage (£14.10 per hour, or around £27,000 per year) and another full-time earner on the National Living Wage) will receive £4,200 this year (£850 from today’s package, £350 from the February package, £350 from the NICs threshold increase, £3,200 from the UC taper reduction).

Our package is both more generous and more responsible than Labour’s proposals

- The lowest income households will receive DOUBLE under our plans – £1,200 compared to £600 under Labour. The package we are announcing today will see a typical low-income household receiving £1,200, with some households receiving £1,650, and pensioner households receiving £850. By contrast, Labour’s own calculations reveal that the lowest-income households would receive only £600 (VAT cut on energy bills = £94, increasing Warm Homes Discount = £400, smoothing costs of supplier failure = £94).

- Hard-working families will receive £550 under our plans – but less than £200 under Labour. The package we are announcing today will see a typical middle-income household receiving £550 through the £400 cash grant and the £150 council tax rebate. By contrast, Labour’s own calculations reveal that the vast majority of households would only receive the VAT cut on energy bills (£94) and smoothing costs of supplier failure (£94), totalling £188 – that’s less than half of what we will provide.

- Labour also admitted that their windfall tax would only raise £3 billion. Shadow Chancellor Rachel Reeves said two weeks ago that their windfall tax ‘would raise about £3 billion’ – that equates to just £120 for every household, rather than the £600 which they have been claiming. That leaves a shortfall of where they would find the additional funding – part of Labour’s growing £90 billion fiscal black hole.

This package supports the whole United Kingdom

- The one-off cash payments to benefits recipients and pensioners will be delivered UK-wide, for which we will legislate for Northern Ireland. We are determining the best way to ensure people in Northern Ireland will benefit from the £400 cash grant for energy bills (£165 million of Barnett). The £500 million Household Support Fund is England-only and will attract Barnett consequentials in the usual way (Scotland £41 million; Wales £25 million; Northern Ireland £14 million).

This builds on our existing £22 billion package of support to help families address the cost of living:

- £9 billion to help households address rising energy costs. We have provided a non-repayable £150 cash rebate for homes in Council Tax bands A-D, equivalent to 80 per cent of all households. We also provided

£144 million of discretionary funding for local authorities to support households.

- Slashing fuel duty by 5p for twelve months. Conservative governments have frozen fuel duty for twelve consecutive years. But in recognition of the unprecedented circumstances pushing up fuel prices, we cut fuel duty by 5 pence for a full year – only the second cut in twenty years, the LARGEST EVER cut across all fuel duty rates, and a new tax cut itself worth £2.5 billion, adding up to over £5 billion together with the cost of the freeze. This will save car drivers £100, van drivers £200, and HGV drivers £1,500 this year. Furthermore, 40 per cent of the cut will benefit businesses.

- The National Insurance personal threshold will rise from £9,500 to £12,570 from July. At the Spring Statement 2022, we raised the threshold from £9,500 to £12,570 from July – the largest increase in a starting personal tax threshold in British history, equivalent to a £6 billion tax cut for nearly 30 million workers and worth over £330 a year starting in July, across the entire United Kingdom. This is the largest single personal tax cut in a decade.

- Cutting tax for low-income families by reducing the Universal Credit taper rate. To make sure work pays, and to help the lowest-income families in the country, we cut the taper rate by 8 pence, taking it down from the current 63p to 55p. This is a tax cut for 2 million low-income families worth £2.2 billion this year, or an extra £1,000 in their pocket. Together with other tax changes, as well as the NLW increase in April, a single mother of two working full-time will be better off by around £1,600 a year – while a working couple with two children, one working full-time and one part-time, will be better off by £3,000 a year.

- Cutting the basic rate of income tax to 19 pence in 2024. It would be irresponsible to do this now, but by 2024, inflation is forecast to be back under control, debt will be falling sustainably and the economy growing. We will therefore cut the basic rate of income tax by 1p, a tax cut worth £5 billion for over 30 million workers, pensioners and savers – only the second income tax cut in two decades and the first income tax cut for 16 years. This will be worth around £175 for a typical taxpayer.

- Scrapping VAT on energy saving materials. Our current VAT relief for families installing energy saving materials used to be more generous. But the European Court of Justice in 2019 forced us to add complex red tape which limited eligibility, removed certain items from qualifying, and restricts VAT relief to 5 per cent. We are now using our Brexit freedoms to remove this 5 per cent VAT charge over the next five years, reverse the EU’s decision to take wind and water turbines out of scope, and remove all the EU- imposed red tape, adding up to a £250 million tax cut for energy efficiency.

- Additional support to help household energy bills. Cold weather payments provide £25 per week in cold weather, supporting 4 million vulnerable households. The Warm Homes Discount provides a £150 rebate on energy bills each for 3 million low-income households. Our Energy Company Obligation saves £300 on bills for 300,000 people in fuel poverty, worth £1 billion.

- Boosting home insulation. Investing over £3 billion to improve energy efficiency in almost 500,000 low- income, fuel poor households, meaning average savings of nearly £300 per year with grants of £25,000.

- Significantly increasing the National Living Wage. The National Living Wage increased on 1 April 2022 by 6.6 per cent to £9.50 per hour for those over the age of 23 – an increase worth over £1,000 to over 2 million full-time workers this year; over £5,000 for a full-time worker since the introduction of the NLW by a Conservative government in 2016; and over £6,000 since 2010. We are committed to going further, so that the National Living Wage reaches two-thirds of median earnings for those 21 and over by 2024.

- Cutting and freezing alcohol duties. We’re introducing a new Draught Relief which will apply a new, lower rate of duty on draught beer and cider – cutting duty by 5 per cent, the biggest cut to cider duty since 1923 and the biggest cut to beer duty for 50 years. This will boost British pubs by nearly £100 million a year – and means a permanent cut in the cost of a pint by 3p. And we are freezing all alcohol duties for the 3rd in a row, including for whisky – a tax cut for families worth £500 million every year.

- Permanently increasing the generosity of the Local Housing Allowance for housing benefit. We permanently upped the LHA to the 30th percentile of market rates last year and kept cash levels at these higher rates going forward. This costs nearly £1 billion a year and has meant over 1.5 million households are benefitting from an additional £600 per year compared to before the pandemic.

- We are investing over £200 million a year to continue the Holiday Activities and Food Programme to provide enriching activities and a healthy meal for disadvantaged children in the holidays.

- The best way to help with the cost of living is to help people into good jobs. Somebody moving from welfare to full-time work on the NLW is over £6,000 better off. Our Kickstart scheme fully funded over 152,000 jobs for young people at risk of long-term unemployment. Restart will help 1.4 million long-term unemployed people. We have doubled the number of work coaches to 27,000. And we’re increasing skills spending by £3.8 billion over this Parliament (26 per cent in real terms) to help people get the jobs they want – skills bootcamps, traineeships, Sector Based Work Academies, apprenticeships, new Institutes of Technology, more post-16 Further Education funding and the PM’s Lifetime Skills Guarantee.

A reminder of 16 TAX CUTS that we have introduced during and following the pandemic:

- Increasing the National Insurance personal threshold to £12,570, a £6 billion tax cut for nearly 30 million workers and worth over £330 a year, starting in July

- Slashing fuel duty by 5p, only the second cut in twenty years and saving car drivers £100

- Cutting business rates by 50 per cent this year for 90 per cent of retail, hospitality and leisure businesses

- Reducing the Universal Credit taper rate to 55p, a tax cut for 2 million low-income families worth £1,000

- Introducing a brand new Super Deduction on capital investment for companies – a £25 billion tax cut

- Raising the employment allowance to £5,000, a new £1,000 tax cut for half a million small businesses

- Removing VAT on energy saving materials, a £250 million tax cut for energy efficiency

- Cutting beer duty by 5p, and freezing all alcohol duties for the third year in a row

- Creating a new half price rate of Air Passenger Duty for domestic flights within the United Kingdom

- Doubling creative industries tax reliefs for our world-leading theatres, orchestras, museums and galleries

- Creating new business rates reliefs to incentivise improvements and green investment

- Extending the £1 million Annual Investment Allowance for a further 15 months during the pandemic

- Reducing VAT to a temporary 5 per cent rate for retail, hospitality and leisure during the pandemic

- Cutting stamp duty for house sales under £500,000 for a total of fifteen months during the pandemic

- Removing VAT from e-books and e-publications

- We will cut income tax by 1p in 2024, the first for 16 years, worth £5 billion for over 30 million workers, savers and pensioners